Clients come to us as they trust us to look after their wealth in a responsible manner, fulfilling objectives such as saving for retirement or school/care home fee provision but also considering their risk profile.

This is key to what we do. It is essential that we have a thorough understanding of a client’s tolerance and capacity for risk so that the portfolio we deliver provides the desired outcome. Once these elements are established we look to create the portfolio.

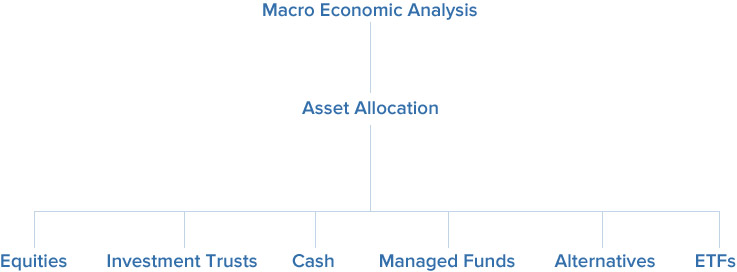

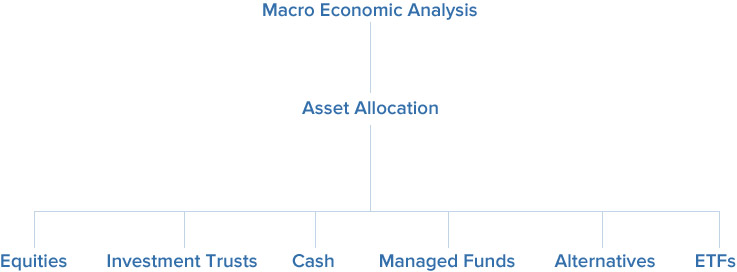

The chart below gives an overview of the process and how we move down from macro economic analysis through to the individual investment selection.

Having carried out a thorough global economic analysis, we begin the construction of a portfolio with a top-down approach. This recognises that asset allocation is proven to be the most important decision in the risk and return profiles of a portfolio. We seek to invest in a spread of assets that have different characteristics both with risk and return. This asset class diversification is designed to reduce the volatility in a portfolio. We will look at a wide range of assets including:

- Government and Corporate Bonds

- UK and Global Equities

- Property REITs

- Commodities

- Alternatives (e.g. Infrastructure Funds)

- Cash

Each of the above has its own characteristics and we seek to hold them either directly or through collective investments, whichever is most suitable for the portfolio and the client.

Whilst we are active investment managers, we do see the benefits of some passive exposure, in particular recognising the importance of the asset class, and also potential cost savings.